how to file back taxes yourself

If you are self-employed you must file. Gather Your Tax Information.

Prior Year Tax Return Software File Previous Year Taxes With Freetaxusa

Loan amounts are 500 750 1000 1500 2500 and 3500.

. If you owe more than 250000. So it makes sense to file your back taxes if it means a refund will come your. Tax Preparation and Planning.

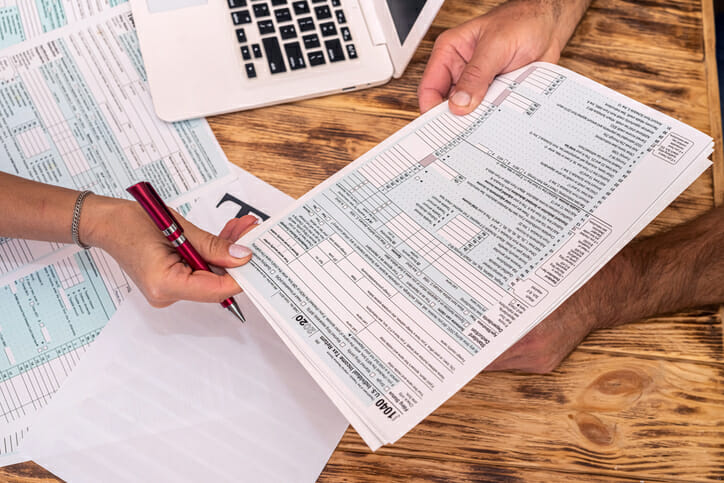

The first step in getting your back taxes filed is to get your own paperwork in order. No unfortunately the HR Block Online program is only designed to be used for the current years returns. To be eligible for the 3500 NFRA your expected Federal refund less authorized fees must be at least 3600.

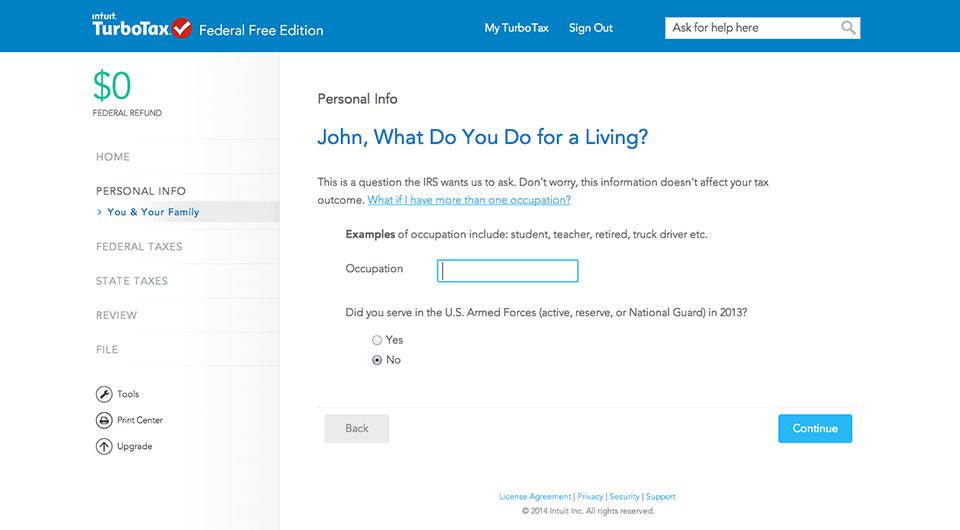

Since tax laws change year. If you want to tackle filing your back taxes by yourself choose a reputable tax software company to assist you. If you owe less than 250000 you can set up a payment plan over the phone at.

To file back taxes youll need to purchase the edition of HR Blocks software. 800-829-1040 individuals or 800-829-4933 businesses. The IRS gives you 3 years from the due date of the return plus extensions to file your tax returns and 2 years from the date of payment whichever is later to claim your refund.

To get your tax return started youll first need to find out how much money you made in 2021. You will not receive duplicates of any W-2s 1099s or 1098s but. The IRS tax code states that you must file an expat return for every year in which you have earned any amount over that years threshold.

Remember tax refunds are essentially interest-free loans you make to the government. Since a composite return is a combination of various. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Though the specific list of forms needed to file back taxes depends on your personal financial situation below are some of the. Fees to file your federal return are prohibited.

Filing back tax returns could help you do one or more of the following. Complete and submit the return forms. The IRS began accepting and processing federal tax returns on January 24 2022.

Alternatively print it fill it out and mail it to the address indicated. To file taxes you need your W-2s and any 1099 forms you have from the. Whether youre a small business owner seeking proactive tax planning or an individual who wants to get the most back on their tax return Michael DiPede.

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. One practical reason to file a back tax return is to see if the IRS owes you a tax. If you choose this email link and qualify you will not be charged for preparation and e-filing of a federal tax return.

Simply fill out the form and submit it online.

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

How To File Your Tax Return Online Digital Trends

3 Ways To File Your Taxes For Free Forbes Advisor

E File Your Tax Returns For Faster Refunds Start Free Now

How To File Back Taxes 2022 Guide

Intuit Turbotax 2022 Tax Year 2021 Review Pcmag

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-b2584d2f80b043d0814fca81c1b1fecf.jpg)

How To Budget For Taxes As A Freelancer

Tax Form 1120 What It Is How To File It Bench Accounting

Learn How To File Returns For Back Taxes The Ultimate Guide Ageras

How To File Back Taxes 2022 Guide

What Happens If You File Taxes Late Northwestern Mutual

How Do I File Back Taxes With The Irs Youtube

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Guide To Filing Your Taxes In 2022 Consumer Financial Protection Bureau

Turbotax File Your Tax Return Apps On Google Play

Filing Back Taxes What To Know Credit Karma Tax

File A Free Extension By April 15 2023 Fill Out File Online Now