do pastors pay taxes in canada

If your employee is a member of the clergy they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits. If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a.

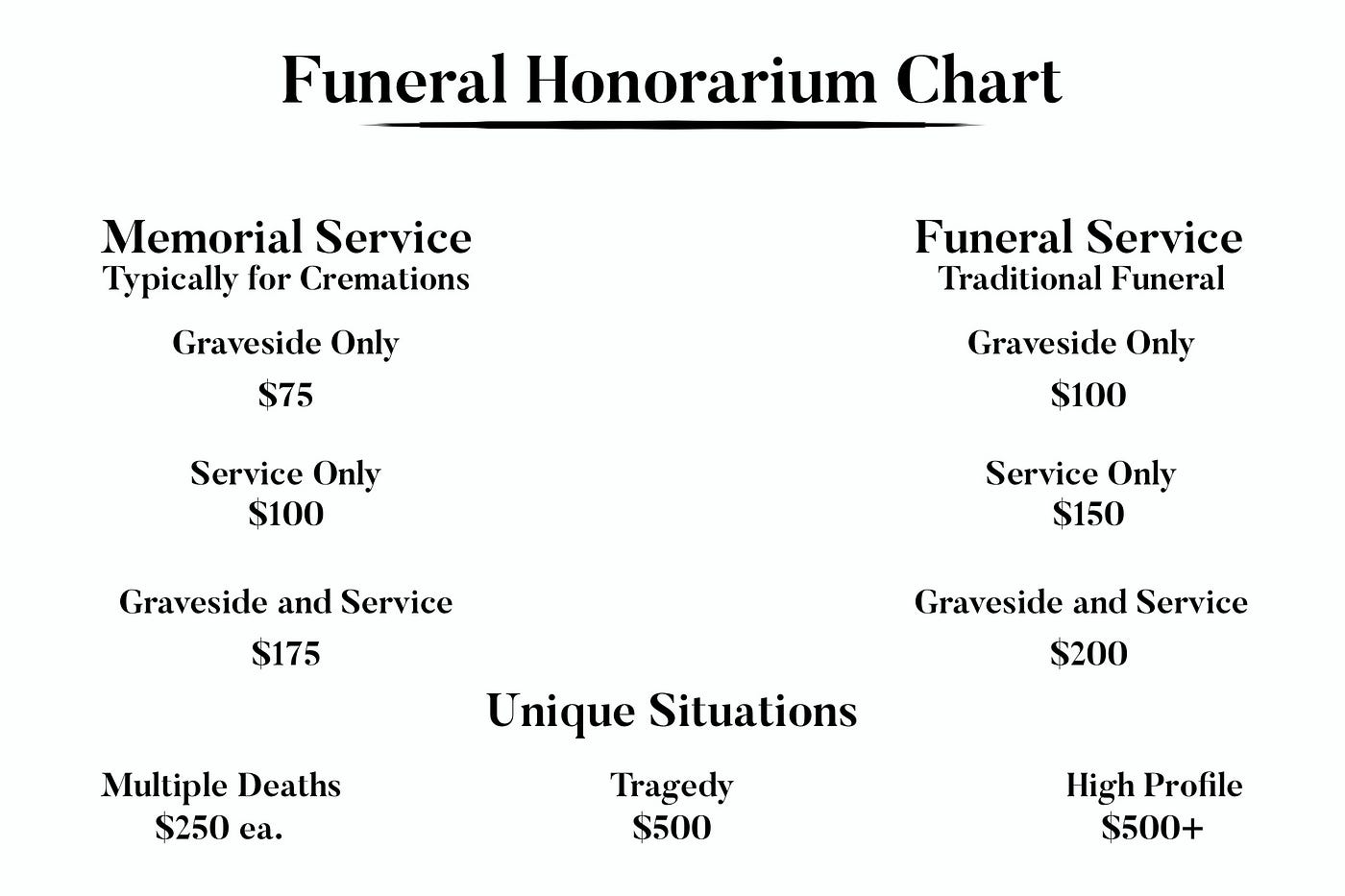

When Do You Pay A Pastor For A Funeral By Brandon Weddle Medium

Taxpayers view ministers as self-employed employees with the same tax deductions as traditional employees.

. For purposes of federal income tax reporting ordained commissioned or licensed ministers of churches engaged in their ministry are generally considered employees. FICASECA Payroll Taxes. Do Pastors Pay Income Taxes In Canada.

If requested by Canada Revenue Agency CRA. Legally a lot of pastors dont report everything they are supposed to. How Much Tax Does A Pastor Pay.

In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or. Self-employed individuals pay 4 of their income toward social security. Gross Salary It used to be that churches when making an initial offer to a pastor based their offer on basic salary and a housing allowance.

Attached as Exhibit A d. It is part of the law that clergy members persons appointed by affiliated with or participating in a religious order and religious workers persons employed by churches. The second option is to split the responsibility with your church.

But yes they pay income taxes in the US. It is generally accepted. Whenever you earn salary wages or other income from your position as a parish priest or a member of a religious order or as a minister of a religious denomination this income must be reported to the IRSThere is an automatic T4 form with Box 30 which shows how much housing allowance you received based.

Quarterly Estimated Payments Employer Withholding. You have them withhold income taxes. Average base salary Data source tooltip for average base salary.

17 salaries reported updated at May 18 2022. The pastor owns hisher own accommodation. A 45 employer portion equal to.

How much does a Pastor make in Canada. 40 of employees plus 1 of those who make up a combined 45. Pastors are able to opt out of social security if they so wish.

Pastors Parsonage Or Own Home Church Investors Fund

Business Ideas For Pastors That Want To Make Extra Money The Pastor S Wallet

How Much Should You Pay Your Pastor The Pastor S Soul

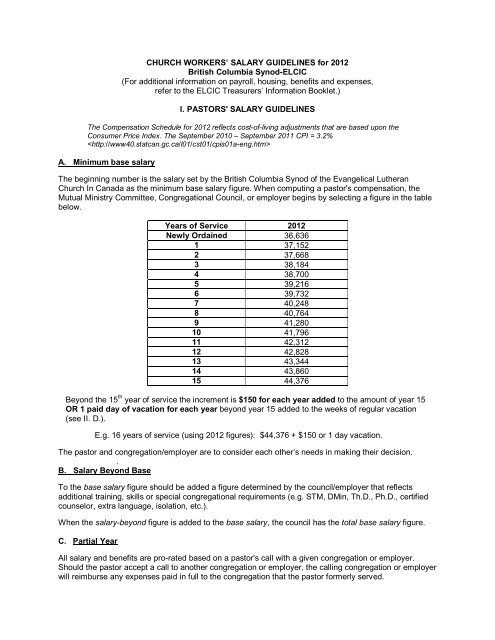

Church Workers Salary Guidelines For 2012 Bc Synod

Buy The Work Of The Pastor Book Online At Amazon The Work Of The Pastor Reviews Ratings

Gifts For Pastor Appreciation Gift Personalized Birthday Etsy

Celebrating Youth Pastors On National Pastor Appreciation Day Ym360

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

Father S Day Gift For Pastor Appreciation Gifts Etsy

Governance Risk And Compliance Solution Ricago Policy Management Solutions Company Secretary

Baptist Pastor Salary Comparably

Are Pastors Employees Or Self Employed Contractors Cbn Com

Huge Infographic On The Business Of Mega Churches Tax Exempt Average Pastor Income 147 000 Many In The Millions Sees Gifts Of Bentleys And Rolls Royces Attendance Growing 8 Per Year Just Take A Look

Buy The Work Of The Pastor Book Online At Amazon The Work Of The Pastor Reviews Ratings

A Local Pastor S Open Letter To The Town Of Aylmer And Those Looking In Michael Krahn

Should Priests And Pastors Pay Tax Quora

Quickbooks For Houses Of Worship Understanding Pastor Payroll Youtube